Initiatives

Smart Industry

Currently valued at $66.67B and expected to reach $152.31B by 2022, Smart Industry market companies leverage disruptive technologies (e.g. AI/ML, Analytics, Autonomy & Blockchain) to enable cyber-physical systems to monitor the physical processes of the system (or factory etc.) and make decentralized decisions. The physical systems become Internet of Things, communicating and cooperating both with each other and with humans in real time via the wireless web. Sciath targets funding companies and projects which include the following characteristics:

- Interoperability — machines, devices, sensors and people that connect and communicate with one another.

- Information transparency — the systems create a virtual copy of the physical world through sensor data in order to contextualize information.

- Technical assistance — both the ability of the systems to support humans in making decisions and solving problems and the ability to assist humans with tasks that are too difficult or unsafe for humans.

- Decentralized decision-making — the ability of cyber-physical systems to make simple decisions on their own and become as autonomous as possible.

SG most recently funded a technology holding company (Sciath.io) focused on licensing technologies and acquiring companies that accelerate traditional companies digitally transform their business models.

Defense & Security

SG believes historic protective barriers have become vulnerable as a result of globalization and the push for economic productivity. More and new protection is needed from evolving threats. New protection requirements digital, physical, personal, enterprise and national- have generated new markets. Any security lapses are no unacceptable. Transformation is being driven through the expansion of IOT, advancing autonomy and location-based technologies into our everyday lives; and expanding analytical capabilities, such as sensor fusion, that enable gleaning insights from previously incomprehensible/disparate data sources. And all these new capabilities need new, automated methods of protection.

SG is actively investing in security & defense “as a service” technology companies with focus on intelligence, cyber security, autonomous robotics, sensors and platforms and supply chain security capabilities. One of the more significant opportunities coming out of the recent rapid globalization trend is security of critical assets, from intellectual property in software to personal identity to physical protection of supply chains and critical infrastructures. The global critical infrastructure security market size is estimated to exceed $1 Trillion by 2025, and companies with applicable products and services that can be leveraged across both commercial and government markets are positioned to surpass the more traditional government-dependent, weapon system focused companies. SG most recently funded an acquisition company, Sciath UAS (www.sciathuas.com) to aggregate and integrate a group of best in class, complementary, remote sensing hardware and software products & services into a “dual-use”, end to end Intelligent Sensing as a Service (“ISaaS”) solutions company.

Cyber

SG believes Cyber is the most important domain of the 21st century. Nations & Enterprises fight daily proxy battles of IP theft, spying for political, military and economic advantage etc. Facing the growing number of criminal actors having cyber capabilities and the ever increasing and uncertain threats in cyberspace, Nations & Enterprises are now investing heavily in both offensive and defensive cyberwarfare capabilities. These investments are being made to (i) protect vital information, (ii) defend critical infrastructure, (iii) deter would-be attackers by having powerful offensive cyber capabilities and (iv) disrupt the development of new nuclear capabilities or like conventional weapons of mass destruction by adversarial and rogue nation state using offensive cyber weaponry, as evidenced by the well-known Stuxnet cyber offensive initiative. As a result, demand for new cyber warfare tools and technologies represents a large and rapidly growing $100B + global market opportunity. Further, the acute demand for next generation cyberwarfare capabilities within the US and its Five Eyes intelligence alliance partners has been enhanced recently by the acknowledged compromise of all existing US cyberwarfare tools by adversarial nation states.

SG is actively investing in “Cyber as a Service” technology companies leveraging AI to provide highly automated turn-key offensive & defensive cyber operations.

Fintech & Crypto

SG believes the next digital wave – the blockchain (“BC”) technology with the new internet of value Web 3.0, will result in significant efficiency gains and the disruption of entire industries. BC technology is an undeniably ingenious invention and bears a potential that is hard to evaluate in its amplitude. However, because BC transactions are inherently encoded, difficult to analyze and query “en masse” its difficult for financial institutions, governments and enterprises to trust, monitor & scale BC deployments into their traditional business & trading models.

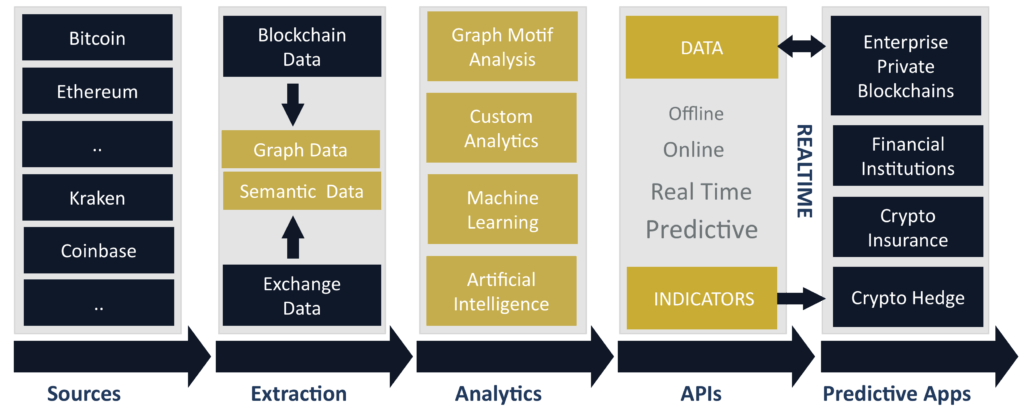

To help bridge this gap, SG founded and funded Sciath Fintech Inc. (“SF”), a BC/Crypto Data Analytics as a Service (“DAaaS”) solutions company focused on helping financial, enterprise and govt. customers achieve predictive insights and safeguard any public or private BC environment. SF’s PREDICT DAaaS Platform combines real-time collection of mempool, blockchain and exchange data, along with proprietary AI/ML tools that provide knowledge indicators for creating predictable crypto trading strategies and advanced BC analytic applications. The PREDICT Platform has been leveraged to create several real time crypto market signals powering dozens of market neutral, systematic, lending/DeFi trading strategies. For more information on PREDICT, please send us a note on the Contact page.

Media

SG believes the media/entertainment industry is the beginning of a business model reinvention cycle. Over the past five years, the entertainment business has spent USD650bn on acquisitions and programming. In 2020 alone, there was over USD100bn in cash invested in new content, which was more than was invested in America’s oil industry. And now, with over 700m subscribers streaming content across the planet, the entertainment industry’s creative destruction cycle has just begun, and no company has more than 20% market share by revenues. Additionally, the world’s largest A-List entertainers have begun to realize they have the ability to build billiondollar businesses by directly monetizing their massive built-in fan bases. At the beginning of this boom period, SG wants to align with these A-List entertainers, content creators, and rights holders to benefit from new-world monetization strategies, next-generation distribution channels, and new methods of consuming entertainment.

Traditionally, most investors have only been able to access A-List entertainer affiliated product/content opportunities by investing in one-off content only projects, which carry poor positions on the return waterfall terms, high concentration, non-liquidity risk & rarely include rights to alternative revenue streams. Hence, SG believes the key to accessing the uncorrelated returns of the entertainment asset class is the combination of partnering with A-List entertainers in owning and operating businesses tailored to their fan bases, an AI-driven “Quantamental” investment approach, & supported by flexible liquidity fund structures.

SG is actively investing in companies who provide capital, technology, infrastructure & operating expertise (i.e. a “company in a box”) like capabilities to help A-List entertainers establish companies to monetize their massive, built in consumer fan bases.